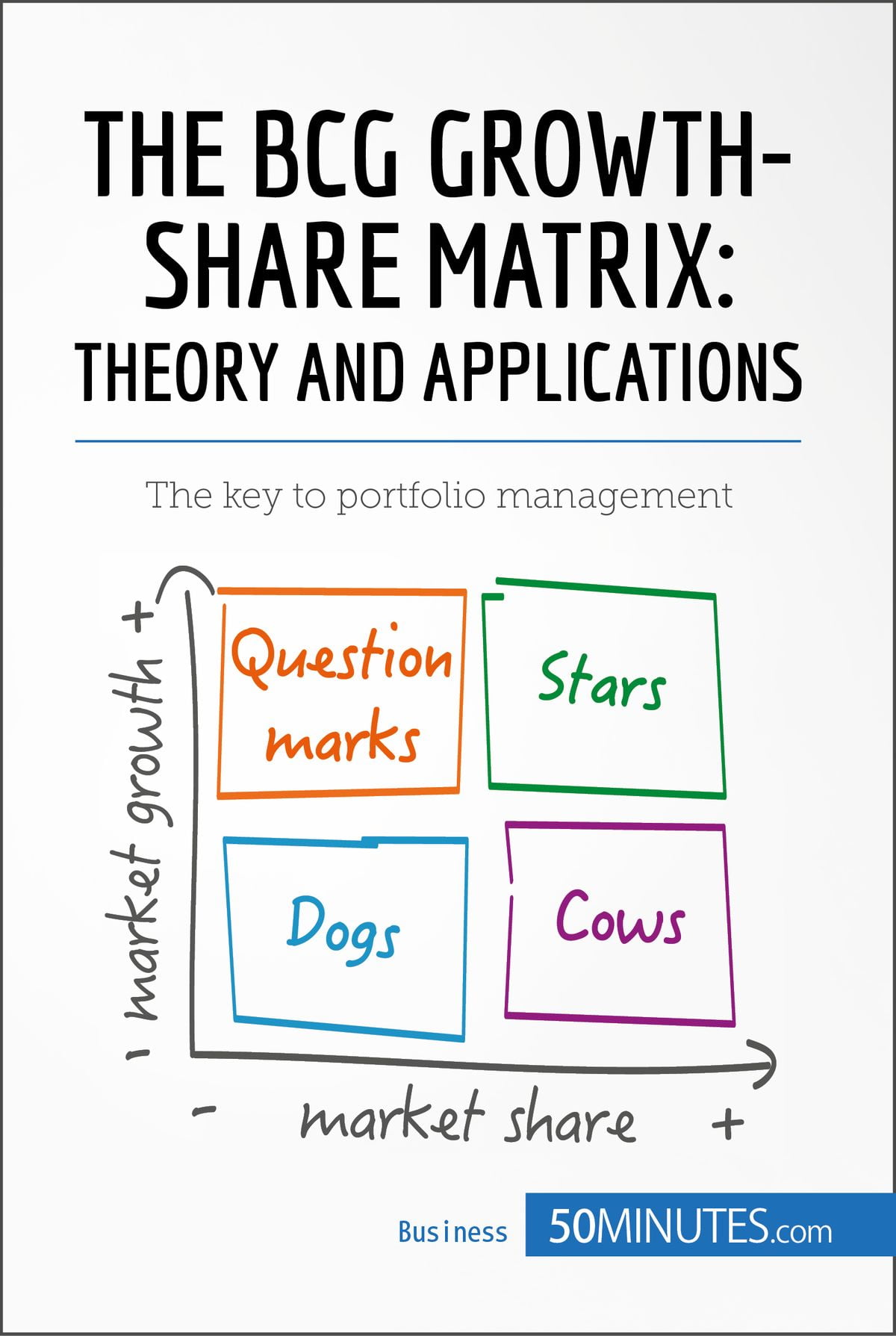

It is a table, split into four quadrants, each with its own unique symbol that represents a certain degree of profitability: question marks, stars, pets (often represented by a dog), and cash cows. Dogs are often the first assets to be sold off. The Growth-Share Matrix (also known as the Product Portfolio matrix) is a tool developed by Boston Consulting Group (BCG). The growth share matrix is, put simply, a portfolio management framework that helps companies decide how to prioritize their different businesses. Dogs – These are low market share assets that show low growth rates. Cash cows – These are high market share assets in a slowly growing market. Stars – These are high market share assets in a quickly growing market. Question marks – These are high growth rate, low market share assets.

List out every product or service you offer, then arrange them into the following four categories:

Wondering how to use a BCG matrix? The process is simple. The BCG Growth Share Matrix is a framework designed for companies to better understand a market’s current and future competitive landscape, which helps determine their long-term strategic plans. This article, the fourth in the series, examines the growth share matrix, a portfolio management tool developed by BCG founder Bruce Henderson. Created by the Boston Consulting Group (hence the name), the BCG matrix offers a way to view all of your product ideas in one place and prep for a total market takeover to give you a competitive advantage as a market leader. The BCG matrix (also called a growth share matrix) is a tool that allows you to make the most of your business plans, marketing strategy, and assets by calculating their market growth and market share.

0 kommentar(er)

0 kommentar(er)